Yes EPF currently offers 81 for. Know about PF EPF benefits interest rates how to transfer EPF money online.

Public Mutual Bangsar Utama 11 15 Jalan Bangsar Utama 3

EPF comes under Employee Provident Fund and Miscellaneous Provisions Act1952.

. For new members of EPF Scheme. For the purposes of managing the Fund and for carrying into effect the purposes of this Act a body corporate by the name of Employees Provident Fund Board is established with perpetual succession and a common seal and which may sue and be sued in its corporate name and. EPF Interest Rates 2022 2023.

Public Mutual Berhad a wholly-owned subsidiary of Public Bank is a top private unit trust management company and leading PRS provider in Malaysia. Public Mutual Berhad a wholly-owned subsidiary of Public Bank is a top private unit trust management company and leading PRS provider in Malaysia. PART II THE BOARD AND THE INVESTMENT PANEL.

As per EPF scheme rules once you get married the previous nomination made by you automatically becomes invalid in your PF and EPS account. July 22 2022 42042 pm. Download the Excel based Income Tax Calculator India for FY 2020-21 AY 2021-22.

Public Provident Fund is not. Mutual fund Investments New. But the benefit of this scheme is added continuously under UAN.

So if the PPF is an indicator EPF interest rates can be lower in this financial year. At 85 this is the largest gap we are seeing when compared to the public provident fund PPF which is at just 71. Automatic transfer of PF details to a new account.

NSE Gainer-Large Cap. EPF rule 2022. We offer a comprehensive range of products comprising conventional and Shariah-based unit trust and PRS funds as well as financial planning services.

Pai CFP and Head - Products PPFAS Mutual Fund replies. EPF Late Payment Penalties. Curated Mutual Funds plans for tax savings MF.

Invest in best Growth mutual funds. Upon late payment of EPF challan two arrears ensue on the employer as follows. The move would bring EPF in line with other social security nets like Employees State Insurance Corporation ESIC which.

EPF Interest for Late Payment under Section 7Q. You may choose to do Public Provident Fund or not. Know EPF or PF interest rate year wise PF interest calculation tax benefits on EPF contribution.

The interest rate on EPF is reviewed on a yearly basis. For every single day that there is a delay in EPF payment. According to EPFO rules ex-employees cannot contribute to their EPF account since any contribution by the member must be matched with the employers share of.

Pro Investing by Aditya Birla Sun Life Mutual Fund. A similar contribution is also to be made by. Establishment of the Board.

It is a PF Declaration Form 11 of their basic EPF details For existing members. Does the EPF offer a high rate of interest. When an employer fails to deposit the EPF contribution before its deadline then he is liable to pay an EPF interest of 12 pa.

Over the career time one shifts a job multiple times. This compares the New Vs Old Tax regime and NRIs can also use this. When the EPFO announces the interest rate for a fiscal year and the year closes the interest rate is computed for the month-by-month closing balance and then for the entire year.

Interest earned from Employees Provident Fund EPF contribution over Rs 25 lakh in a year is taxable Written by Rajeev Kumar Updated. As per the EPF rules 12 of the employees salary ie. We offer a comprehensive range of products comprising conventional and Shariah-based unit trust and PRS funds as well as financial planning services.

Moreover you can think of EPF as a debt mutual fund SIP but with much lower risk and without having to pay any capital gain tax. When the employees salary is more than 15000 and the organization heshe is working in has more than 20 employees. EPF is an excellent saving scheme for building a sufficient retirement corpus for salaried employees.

Employee Provident Fund is more beneficial than Public Provident Fund as you benefit from employer contribution as well. The EPF interest rate for the fiscal year 2022-23 is 810. The wage ceiling for mandatory EPF benefits is currently set at Rs 15000.

Central Public Sector Enterprises and the Bharat 22 indices. Basic plus dearness allowanceDA needs to be contributed towards the employees EPF account. Mutual fund investments are subject.

Public Mutual Pocket Calculator From Public Mutual Facebook

Epf Investment Calculator Jaroncxt

Public Mutual Bagi Yang Nak Semak Kelayakan Anda Dlm Facebook

Diversify Your Retirement Nest Egg

Handsome Return For Equity Fund Investor Kclau Com

Public Mutual Fund Random Thoughts

Kita Boleh Keluarkan Public Mutual Unit Trust Consultant Facebook

Unit Trust Epf Akaun 1 Archives Niksuhaimi Com

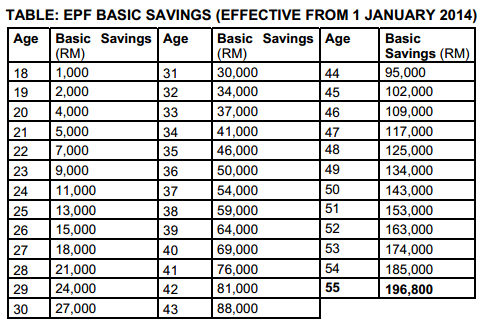

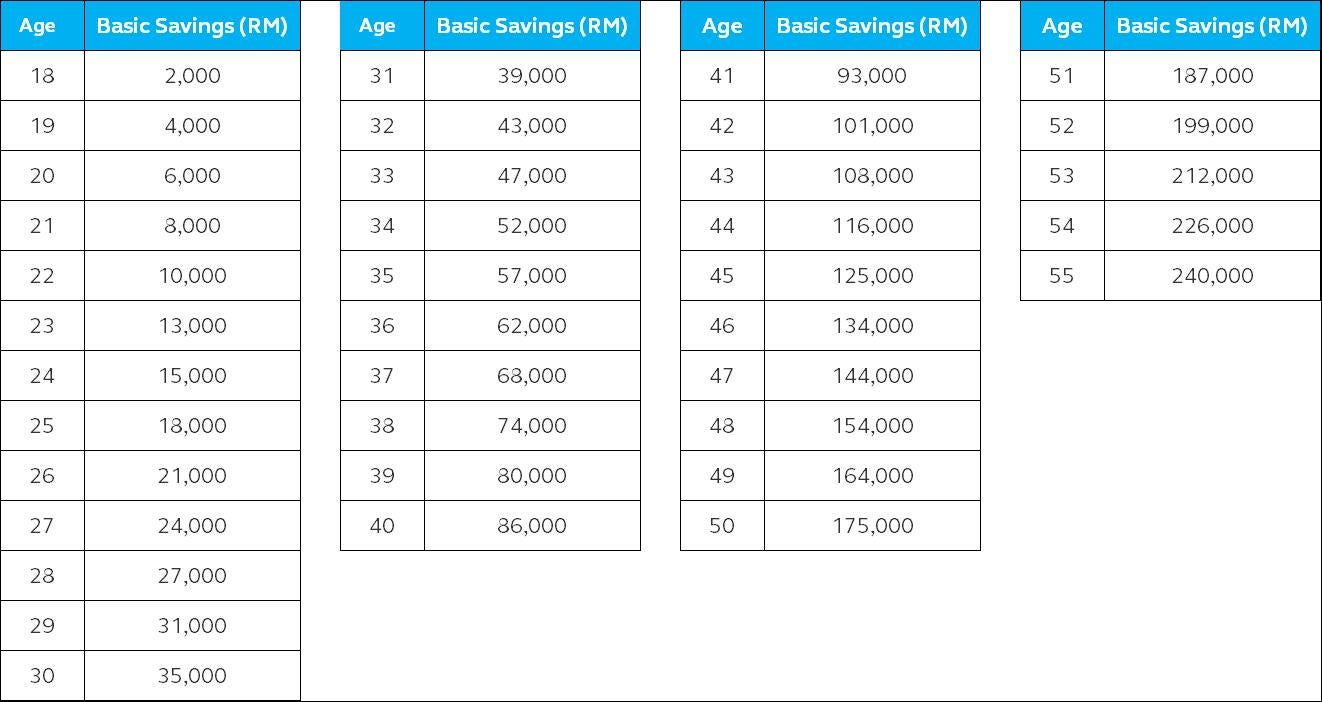

The Impact Of The New Basic Savings Table For Epf Members Investment Scheme Effective Jan 2014 Myunittrust Com

Sales Cut Off Date 2018 For Unit Trust Agent Public Mutual Myunittrust Com

The Impact Of The New Basic Savings Table For Epf Members Investment Scheme Effective Jan 2014 Myunittrust Com

General Information I Invest By Epf Via I Akaun Principal Asset Management

Maryjaunginmolondoi Blogspot Com Pelaburan Kwsp Epf Dalam Unit Trust Public Mutual Labur Tanpa Keluarkan Sesen Pun

Grow Your Wealth With Unit Trust

How To Invest Public Mutual Fund Using Epf Malaysia Financial Blogger Ideas For Financial Freedom

Uneedtrust Where Trust Is Mutual

Pelaburan Public Mutual Guna Akaun 1 Kwsp Myrujukan